Investment Risk Mastery with Profit and Peace

- Balaji Kasal

- Sep 19, 2024

- 3 min read

An intelligent investor exhibits desirable emotional traits, business evaluation, proper valuation, and consistency in performance.

On the other hand, a person could perform by luck. It could happen for some time. ‘Even a stopped clock is right twice a day.’ Ideally, the person should be thanked for a ‘free’ gift and appreciate luck’s role in the performance.

However, when someone mistakenly considers luck as their skills or expertise, they fall into a trap. Their behavior in the stock market is destined to suffer. It is the risk.

You will make better decisions once you recognize and effectively deal with your biases. This is your path to self-reliance. For an investor, these things evolve over time through continuous learning. They are ingredients for your effective decision-making practice.

One of the basic problems market participants face when they buy any security is that they don’t know what and why they bought it. They have no understanding of the business, management, or valuation. Hence, any drop in price causes them to feel a loss even if there is no change in the business prospects. Indeed, it is time to purchase with an improvement in the margin of safety. Hence, your insight and conviction are vital to the long-term investment game.

Conviction comes from owning a business in your CoC-S; trust in management and valuation is favorable. It gives you the strength to hold on to a company in a market turmoil, which could turn into a multi-bagger. Otherwise, a trader sells quickly to pocket only a few percentage gains or take the losses.

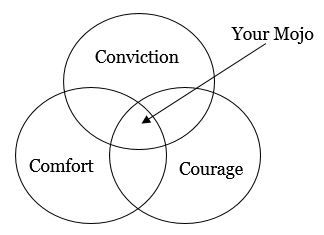

Your conviction must strengthen your courage to invest in and participate in the business's growth. These two must be felt strongly in order for you to allocate sizeable capital to the opportunity.

Further, they have to comfort you about holding the business. You could hold as long as your investment thesis is intact or you find a better opportunity—opportunity cost.

An investor’s courage to withstand a conviction is often tested in the marketplace. But your comfort makes your journey joyful and gives you peace of sleep.

Further, in the investment game, you need to have the discipline to understand yourself, financial goals, framework, and character to stick with it. It is an emotionally difficult task. Hence, most people take shortcuts and rely on hot tips, only to regret it later. As an intelligent investor, you must manage your investment affairs more diligently. Hence, cultivate discipline and persistence. It will give you an edge and take you far in the game.

You will become independent when you get into the core long-term investment theme of the 3Cs – Conviction, Courage, and Comfort. They keep you grounded in bull as well as bear times.

Practice equanimity to avoid any distractions in decision-making and distinguish what matters and what doesn’t.

You could outshine if you make your identity as an Investor. It changes the complete perspective. You get empowered to make effective decisions and conduct affairs that you want. Importantly, it keeps you in the investment game for a long time.

My new book is launched - 'The Intelligent Investor's Risk Mastery'.

You could grab a copy of the book at various platforms. The links are as follows –

· Amazon: https://relinks.me/B0DF1M8V7L

· Apple Books: https://rxe.me/6689522091

· Rukuten kobo: https://www.kobo.com/in/en/ebook/the-intelligent-investor-s-approach-to-risk-mastery

Thank You.

Comments